Have you ever observed that previously the economy used to be cash-oriented? What changes took place? With technological enhancements increasing day by day, the accuracy of the transaction is also growing. In 2016, over 23 countries are making their economy a cashless economy by introducing Digital Currency and making new laws to process financial transactions.

It is increasingly expanding. So, let’s dive in to the topic and find out the many ways in which currencies are used. The statistics can give more idea about what a digital currency is.

- According to ICO Making, there are 153 Billion Bitcoin user addresses in 2019. It has 550,000 active addresses. Account adoption amounts to 23,343.

- The number of blockchain users increased to 25,952,849. By predicting the analysis, we can predict the number of users that is between 13 million and 25 milli

- According to News logical, the United States has $6 billion of daily transactions, which stands third after VISA and Master Card.

- Digital currency history

- Digital currency definition

- How does it work?

- Digital currency types

- How do I invest in digital currency

- Best ways to invest in digital currency

- Buying digital currency

- Digital currency services

- Digital vs virtual vs traditional vs cryptocurrency

- Digital currency mining

- Trading digital currency

- Digital currency examples

- Security

- Platforms

- Limitations & benefits

- Future

- FAQs

- Final Thoughts

History of Digital Currency

Before knowing about the digital currency(1), it is better to know about its history. It is also known as cryptocurrency. Going back in 1990, DigiCash was introduced because of the bankruptcy in Amsterdam in 1998.

After that, many companies started coming into the scenario like e-gold, where users used the name ‘digital currency.’ In 2009 the Bitcoin was introduced, which found the blockchain-based digital currencies forms with no focal server and no unmistakable resources held for possible later use.

Otherwise called cryptographic arrangements of money, blockchain-based computerized currency standards demonstrated impervious to endeavor by the government to manage. It happened because there was no focal association or individual with the ability to turn them off.

There are many different types of digital currency, such as Ethereum, Ripple, Litecoin, Tether, Bitcoin Cash, Libra, Monero, EOS, Bitcoin SV, Binance Coin that are currently active on a global scale.

What is Digital Currency?

A digital or computerized currency existing electronically processed by cryptographic algorithms and encryption techniques to make secure transactions.

It is a broad term that contains anything to represent the value digitally. It is used as an entity that can be transferred between objects and users with the help of technologies such as computers, smartphones.

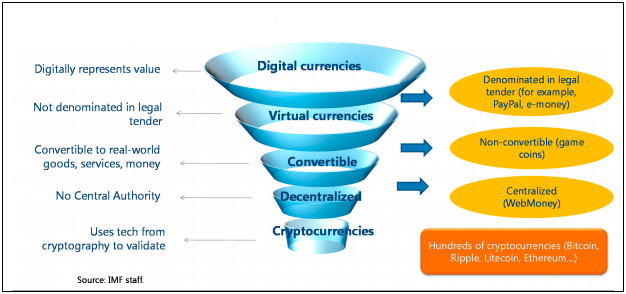

Taxonomy of Digital Currency

In this process, we confirm that electronic equipment is there of the legal tender or not. For cryptocurrency services to get activated there is a requirement of electronic gadgets. If there is any medium for electronic money like PayPal, otherwise, there is another option for virtual currency. There is also the provision of centralized cryptocurrency, which is also known as centralized virtual currency and cryptocurrencies like Bitcoin, Litecoin.

How Does Digital Currency Works?

Although there are so many digital currencies, the mechanism behind it is the same. It is only the basics that are required to know about the different types of digital currency. They work with the process such as

-

Digital Currency Networks: Blockchain

Blockchain is a technology where the digital currencies created, stored, and exchanged on the network. Blockchain has a separate protocol that is an individual creation. The protocol helps to transfer the money. It provides frameworks like Unique and non-duplicable, non-repudiable, limited in supply, durable and immutable, divisible, and uniform.

-

Storing Digital Currency: Wallets

After digital currencies get mined on blockchains, or you can say if it is transferred to the users, they must be stored under their new owner.

Digital wallets are where the transactions take place with the help of a public key and one private key. The public key and private key is one of the concepts of cryptography, where it is used to send and receive currency.

-

Mining A Process for Exchanging and Creating Cryptocurrency

Have you ever thought once you created your cryptocurrency, how will you use, and how will you eliminate the chance of any fraud?

It’s just plain obvious, and advanced cash’s blockchain organize is an open record of all exchanges of that money that have ever happened. New transactions are gathered into ‘Blocks.’ Each square is affirmed and approved by various clients all through the system before being included toward the finish of the chain. Each client has their duplicate of this open record, and it’s continually refreshed.

Miners have the obligation of affirming all the exchanges inside another Block so that the Block can be fixed and recorded on the open blockchain record. To approve a Block, miners contend with each other to make something many refer to as a hash, a one of a kind succession of cryptographic data dependent on:

- The exchange information inside the block being affirmed.

- The result of all mathematical formulas.

- The previous hash of the last round in blockchain.

(Download Whitepaper: The Future of Currency)

Different Types of Digital Currency

When you are using digital currencies, you should know the types of digital currencies and how to invest in cryptocurrency. There are a lot of digital currencies that are available in the market. To make any transactions, you should be familiar with digital currencies. Some of them are as follows

-

Bitcoin

The first digital currency which has open-source blockchain software protocol is Bitcoin. At present, Bitcoins maintains the highest exchange volume, market cap, and rate, which is mostly preferred by people all over the world.

-

Bitcoin Cash

It was found on August 1, 2017, with the name of a hard fork. This was made to skip the existing rules or original bitcoin and make the new rules for the bitcoin. There were two different views which came up in the community concerning the design and scaling of the original bitcoin and blockchain. The users diverged and formed this Bitcoin Cash

-

Ethereum

It is not a purely cryptocurrency, but it is also a distributed computing platform. It also has a platform for decentralized application development that harnesses the power of many computers. Applications that are built to run in Ethereum have to pay the network in Ether to run and getting mine. This is the thing that made me different from the rest of the currencies.

-

Ethereum Classic

It emerged in the same way as Bitcoin Cash, which got split from the Bitcoin Blockchain Network. It has a hard fork of its own. There were many disagreements regarding various technical aspects of primary blockchain which split this network.

-

Litecoin

It was developed by the Google employee Charlie Lee in 2011. It is built on the same protocol of blockchain.

-

Ripple

The ripple blockchain network operates ripples. It is more than a cryptocurrency served as an advanced, decentralized payment protocol. The Confirmation by consensus is a protocol to make transfers instantly without physical movements.

-

Zcash

It ran on the Zerocash protocol and was created in 2016. The best things are about uncompromising privacy, which is a critical factor in cryptocurrency. It allows the sender, recipient, and amount to get transferred to be encrypted and gives the user a choice to disclose the details on the blockchain purposes of public records.

-

Stellar Lumens

It was found by the co-founders of ripple, which were created in 2014. It is the best competitor of ripple. Ripple is a closed source, and Stellar is open-source. The markets of ripple are large banks. Stellar has a market of institutions in developing countries. The FBA algorithm and decentralized exchange. Its first coins are known as Lumen.

How to Invest in Digital Currency?

To understand the best digital currency to invest in, you need to get a clearer understanding of the fundamentals of cryptocurrency. Flat money and cryptocurrencies are exchanging medium. It is also called as a store value. Investors should be educated about the trends in digital currencies they are investing in.

Cryptocurrencies are not difficult to understand. The rules are standard before you invest; you make things well scripted. The fundamentals, team, history are terms you should know about

Some of the significant things which you should know are

-

Supply and demand

Seeing the market rate and trend will make you decide where to invest.

-

Which currency you should prefer

There are hundreds of money, you need to invest in that cryptocurrency where you have a proper understanding.

-

What type of investment you are looking for

You should be able to decide your investment expectations and then decide where you want to invest and how much you want to spend?

-

Knowing about the security in Digital Currency

Every cryptocurrency has different security levels, which are the most important. Investing money through the digital world is always risky. But out of the various securities, you need to choose one and spend it.

Best Digital Currencies to Invest In

There are many currencies where you can spend money, but out of that, it has some coins where you would not find any profits, and in some conditions, you may only lose the money, but there are some great examples of cryptocurrency where you can think to invest your money.

-

Bitcoin

The one-bit coin value is around $8,994.85 on January 28, 2020. It offers 6.25 BTC instead of 12.5 BTC for verified blocks. It is better than all other altcoins. It is a bit con with the most significant market capitalization.

-

Ethereum

It is based on practical smart contracts that are used for projects to digitalize the transactions. The implementation of the Proof-of-Stake algorithm is worth it in 2020. The current price is $171.38.

-

NEO

It is a cryptocurrency which will rise in the upcoming year; it is a first open-source originated from China. It also has a superconduct trading mechanism that allows users to trust the funds with a decentralized platform. Its current price is $11.14.

-

EOS

The Chinese have stated the most promising cryptocurrencies in upcoming years. Even if you don’t know much about cryptocurrencies, you can invest and earn profits in 2020. It is scalable and has a competitive advantage. The Consensus algorithm of delegated proof of ownership gives great authenticity to the users, and the current price is $3.94.

Best Way to Buy Digital Currency

Researching and testing products play a vital role in buying the best cryptocurrency. Before you look for the best place, the internet is filled with a lot of information that is required to get the best platform for cryptocurrency transactions. In the cryptocurrency industry, you must be aware of hefty transfer fees to other digital wallets. Read on further to know about the best places to invest in bitcoins

-

CoinBase

It is the most respected, preferred platform in the world. It offers both exchange and wallet in one platform. If you are at a beginner stage in investing Bitcoin, this place is for you. It supports Bitcoin Cash, Ethereum, and Litecoin.

– Easy Sign up with quick addition of bank account

– 1% charge transaction for transactions from Coinbase USD wallet

– Secure Wallet

– Easy access through web, Mobile app

– Two-way authentication

– digital and paper backups of data are in safe places

– Insurance of cash balance up to $250,000 against theft, the breach in online storage

– It holds 98% of customer currencies offline to keep it safe from hackers

-

Robinhood

– No fees for buying and selling Bitcoin and other digital currencies

– It was only available on mobile-first. Now it has made available on the web.

– It supports Bitcoin and Ethereum

– It helps in 16 countries

-

Binance

– It supports a wide range of currencies which includes Bitcoin, Ethereum and Binance Coin

– It has meager fees, only 0.1 percent for trades.

– It offers trade coins into multiple currencies, including EOS, Skycoin, TRON, ICON, Ethereum Classic, Litecoin, Ripple, Stellar Lumens, Bitcoin Cash.

– Perform a massive range of currencies at low cost

Best Digital Currency Services

The best digital currency services where you get a safer transaction and more reliability with its algorithms. There are most preferred cryptocurrency services are

- Ethereum

- Ripple (XRP)

- Litecoin

- Tether

- Bitcoin Cash

- NEO

- EOS

The more we use the digital currency, the more we know the benefits. The key benefits are as follows:

- Has the potential to disorder financial services by reducing the cost and complexity of financial transactions.

- It benefits sectors such as healthcare, government, law, education, technology, and more.

- Cryptocurrency cannot be counterfeited.

- It provides anonymity.

- It uses push models where makes the exact amount to be sent to the seller without any other information.

- Lower transaction costs.

Difference between Digital, Virtual, Traditional and Cryptocurrency

There are some pros and cons of digital currency which tells the overview of your selection and get a grip on what to select for the transactions.

| Digital Currency | Virtual Currency | Cryptocurrency | Traditional Currency |

|---|---|---|---|

| With a broad meaning, It is the currency that is available in digital form. Any cash situated in 1’s and 0 meets this definition. | “Virtual” can be characterized as “not situated in physical reality,” and virtual currency forms are those who are not planned for use, “in actuality,” or use on substantial resources. | It is a highly secured type of currency which is encrypted using advanced algorithms and cryptographic technique for security purposes. | Traditional Currency is the cash that is given by the Financial Authority of a nation. |

| Virtual Currency, cryptocurrency, and central bank digital currency are all types of digital currency. | All virtual currencies are digital, but not all digital currencies are virtual. | Bitcoin is the most common type of blockchain-based cryptocurrency. | The traditional money comes from banks that are held on computers. It is also considered digital currency. However, they are not presented digitally. |

| The future of digital currency forms are what they sound like: monetary standards put away and moved electronically. | Virtual currency is mostly owned by private issuers, developers, or some foundation company. | This is fully decentralized and not surrounded by legal frameworks, The directories are visual to all, and it is highly encrypted. | It is estimated as cash, in addition to stores of banks and different organizations at the national bank. |

| Dollars put away in a ledger should be a portrayal of dollars really held someplace, though physical bitcoins are a portrayal of their advanced partners. | Virtual money is the form of digital currency that uses blockchain but don’t have a centralized banking authority. | Cryptocurrency utilizes the blockchain method to maintain the integrity of the transactions. | It is additionally that cash that can fulfill the save necessities of business banks. |

What is Digital Currency Mining?

Crypto mining is a process where the transactions for various types of cryptocurrencies are verified and added to the digital ledger. Each time a cryptocurrency transaction is made, the authenticity of the information is checked with the update of blockchain.

In simplest terms, mining is all about validating the transactions. Generally, miners use dedicated computer hardware with specialized GPU chip or ASIC. As cryptocurrency is becoming more and more popular each day, the mining techniques and tools are also advancing at a fast pace.

What is Digital Currency Trading?

The digital currency trading is a concept of using the currency for capturing the sale of consumer products on the internet. The digital option allows traders to gain profit from correct predictions on the future price of an asset.

Generally, the term used for trading cryptocurrency is foreign exchange. So, you’ll mostly come across terms like Forex Trading. Currently, cryptocurrency trading is not legal in many countries. However, you can always leverage from trading by investing in international exchange.

While some people consider trading cryptocurrency a risky matter if you have trading skills, you can gain a certain amount of profit. So, we recommend you putting your trading skills to test with tools like Free Stock Simulator so that you can compete with expert traders.

What are Digital Currency Properties?

With so many digital currencies, they have so many different features and properties. The unique properties light on the pros and cons and help to find the best way to buy cryptocurrency. Let’s take a few minutes to describe these various properties which are listed below

-

Transactional Properties of currencies

There are several transaction properties of cryptocurrencies that are mostly found in all currencies. Some of these are

– Permission Free

– Irreversible

– Highly secure

– Instantaneous

– Anonymity

-

Monetary Properties of currencies

The cryptocurrencies have some commercial properties, and these properties make a difference from the other forms of money. Let’s take a look at factors such as:

– No Debt

– A Controlled Supply

Examples of Digital Currency

It is available in the form of digital money some basic examples, which are virtual currencies, cryptocurrencies, central bank cryptocurrency. There are two types of coins that are hard and soft digital currencies that are concerned with cryptocurrency security.

-

Hard Digital Currencies

It does not have the ability to get reused; it is nearly impossible to reverse the transactions. The advantages are cheaper to use and instantaneous transactions

-

Soft Digital Currencies

It is the opposite of hard digital currencies, and payments can be reversed. PayPal is an example of soft Digital Currencies.

Digital Currency Security

The digital currency platform tells about the widespread usage which is not easily exchanged or used. The volatility is increased and has a pump and dump schemes.

Due to all the threats posed on digital currencies, making the transactions secure is vital. Different layers of security are added on devices that operate digital transactions. Moreover, multiple software, password manager, two-factor authentication, anti-virus, and anti-malware software can be used for the protection of the cryptocurrency.

Digital Currency Platforms

Some platforms are mentioned for a cryptocurrency where it has many platforms in which there are transactions. With the large no of platforms, it gives users various ways to have operations. The top platforms that deal with digital currency include:

- CoinBase

- Kraken

- IO

- ShapeShift

- Poloniex

- BitStamp

- CoinMama

- Bisq

- LocalBitcoins

- Gemini

These platforms have a license to operate in countries like United States, Hong-kong, Japan, Canada, Singapore, United Kingdom, etc.

Digital Currency Pros and Cons

With so many cryptocurrency platforms, several pros and cons provide benefits as well as the drawbacks, which are discussed in the below section of cryptocurrency.

Digital Currency

Benefits of digital currency:

- It requires lower fees for the transactions

- Fraud Protection

- Simpler International Payments

- Insurance

- Low cost

- Decentralized

Limitations of digital currency:

- The volatility of prices

- The lack of trust

- Lack of regulation

- Volatility

- The used case

Future of Digital Currency

Technology is growing every day, so we never know until we check the web every day. In the upcoming days, many cryptocurrencies are yet to be generated, which will have more regulations and implications in their algorithms to enhance the features in blockchains.

Frequently Asked Questions about Digital Currency

Q. How do you create your own digital currency?

A. You can create your own digital currency by knowing all the latest scenarios of cryptocurrencies. Doing a bit of Market research will help you to get the trends of cryptocurrency. Thereafter you can get ideas to plan for creating your own cryptocurrency.

Q. Is digital currency a good investment?

A. Yes, it is a good investment because there will be an increase in digital payments. The adoption of digital payments will be more in all the industries. Planning investment in cryptocurrency is a valuable approach.

Q. What is Bitcoin digital currency?

A. It is a decentralized digital currency without any central bank that can be sent using peer to peer connection in the Bitcoin network without any intermediaries.

Final Thoughts

The conclusions come with the proper use of digital currency. The transaction with bitcoin gives you the safest way to perform operations, but you need to choose which currency provides the value in terms of security, benefits.