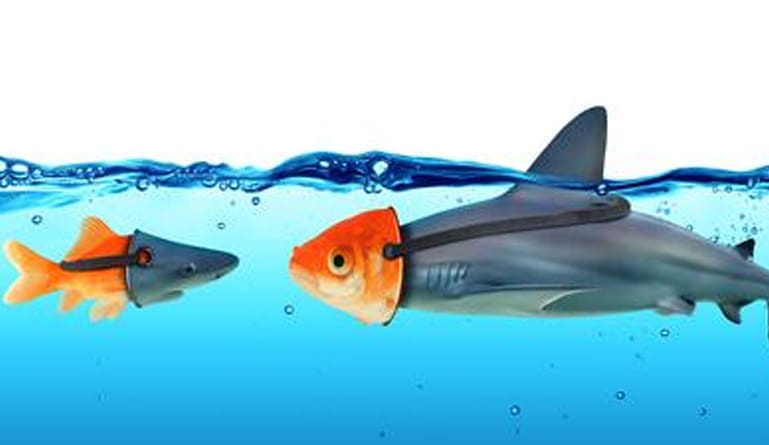

Today, it is true that deception in technology plays an essential duty in making sure that financial services organizations are secure. Deception is necessary as it is used in the process of combating fraud which happens mostly through cyber-attacks in the financial sector. For this to happen the individuals in the information technology sector must have more advanced skills to make sure they counter-attack the cyber-attacks.

Recently, many financial institutions across the world have gone to the extent of making sure that their operations have systems which are technologically related. They have done this through the process of digital transformation which enables them to have the capacity of providing excellent services and also work smarter, faster and more efficiently. Through doing all the above, reduction in operational costs and money used to expand the institutions is noted.

The services of deception are provided by deception vendors who are tasked with the role of making sure that those institutions have enough knowledge on how to deal with cybersecurity. Of late, the presence of many vendors has come up with competitive fees of offering the services to the institutions. For example, several deception technology companies provide venturing services. Some of these companies include Illusive Networks which is based in Israel, Attivo Networks in the United States which is tasked with the role of detecting a threat to the financial institutions.

Also, another deception company across the globe is Smokescreen limited which helps in identifying cyber-attacks, data theft and loss of credential. Deception technology markets exist nearly in all places across the world as there are many financial institutions. Every institution, due to completion and the desire to keep itself competitive, and make sure customer’s accounts are not tempered, should make sure that they employ this technology. Thus, in the end, it results in making them a worldwide market for this technology.

Banks, for them to make sure they are secure, investing in cybersecurity to or an even attack which occurs from the different organizations. Thus, this is achieved by making sure that cyber deception technology is operational and the relevant qualified companies and vendors are tasked with the role of providing the services.

Hence, financial institutions need to choose the best deception technology from the providers for them to be sure that cyber-attacks don’t occur. By applying this technology, the banks will achieve the people engine and make sure that there are automation in-services entirely provided in nature. Also, this helps in making sure that there is good governance and control of the institutions as only systems are used to manage them. For example, there are several examples of deception technology, some of them include firewalls, and it helps much in fighting cybercrime in financial institutions.

Deception technology in financial institutions helps in improving both cybersecurity and networks in an apparent strategy through making sure that attacks and false positives reduce to a minimal number. Thus, through managing, these institutions have gained enough knowledge on how to deal with the threats of cyber-attacks and how to respond to them.