Customers are at the center of any business. Without a consistent stream of new clients, even the most high-quality goods and services can fail. As a result, businesses spend a large portion of their budget trying to draw in new customers. We call this the customer acquisition cost (CAC).

While CAC is a crucial investment for the company, it can also pose a financial challenge, potentially draining its resources with each new customer. Companies counter this by factoring in the value these new customers bring, which is the customer’s lifetime value, or LTV.

Planning and budgeting for expansion must consider these two metrics. In this article, we’ll explain how to calculate Customer Acquisition Cost vs. Lifetime Value and discuss tactics that can help your business expand without sacrificing earnings.

What is Customer Acquisition Cost (CAC)?

Customer acquisition cost (CAC) refers to the amount of money a company invests in converting leads into customers. This metric allows you to select the tactics that provide the highest gain in the number of customers at a reduced cost.

Though its exact components can differ depending on your business, it generally encompasses the following:

- Marketing expenditures, like advertising, creatives, and event costs.

- Sales costs, such as commissions and travel expenses.

- Other expenses, such as employee salaries, bonuses, benefits, training, tools, and software

- Number of new customers

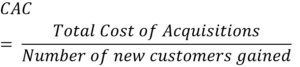

Calculating Customer Acquisition Cost

Simply add up all of the expenses related to bringing on new clients, then divide that amount by the total number of new clients you have successfully brought on board during a given period.

- First, set a specific time frame. It could be a month, a quarter, or a year.

- Add up all the expenses of the various components. Let’s name this “Total Cost of Acquisitions.”

- Identify the total number of new customers you gained during your chosen period.

- Use the following equation:

For example, you want to find out how much your acquisition is for the second quarter of 2024:

| Expense Category | Amount |

|---|---|

| Paid Advertising Costs | $10,000 |

| Content Creation (Blog, Videos, etc.) | $5,000 |

| Public Relations & Outreach | $5,000 |

| Marketing Team Salaries | $35,000 |

| Sales Team Salaries & Commissions | $45,000 |

| Sales Enablement Tools | $2,000 |

| Webinar & Event Expenses | $4,000 |

| Total Marketing & Sales Expenses | $106,000 |

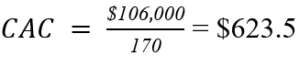

Now, suppose you gained 170 new customers during this period. Using the equation, your CAC would be:

Let’s try to relate this to smaller businesses. You’re trying to grow your Etsy shop and want to understand your acquisition cost during March 2024.

| Expense Category | Amount |

|---|---|

| Etsy Ads | $50 |

| Social Media Advertising | $100 |

| Packaging Materials & Branding | $30 |

| Email Marketing Software | $10 |

| Total Marketing & Sales Expenses | $190 |

In March, you gained a total of 15 new customers. So, your CAC would be:

What is Customer Lifetime Value (LTV)?

On the other hand, Customer Lifetime Value, or LTV, is the total amount of money a client has brought in throughout their relationship with your company. In the present market climate, this indicator has become essential, especially since CAC has increased significantly over the previous eight years—by 222%.

The lifetime value drives home the importance of customer retention. Maintaining long-time customers is 6-7 times cheaper, and they typically spend 67% more than new customers.

Before you can calculate the LTV, you need to consider the following components:

- The average purchase value, which is obtained by dividing the total income from all purchases made during a specific time by the total number of transactions.

- The purchase frequency, or the number of times a client purchases within a given time frame.

- The average time a client actively transacts with your firm called the Customer Lifespan.

How to Calculate Customer Lifetime Value (LTV)

Unlike CAC, calculating your LTV is much more complicated, as it involves combining multiple formulas. We’ll use these formulas to determine Starbucks’ LTV with the help of data from Kissmetrics.

1. First, calculate the Average Purchase Value.

According to Kissmetrics, Starbucks’ customers spend an average of $5.90 per visit.

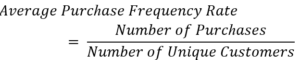

2. Calculate the Average Purchase Frequency Rate.

The next thing we need to know is how many times a week the typical consumer visits Starbucks. The report states that consumers visit Starbucks 4.2 times a week on average.

3. Calculate the Customer Value.

Now, multiply the average purchase value by the average purchase frequency rate to determine the customer value.

Customer Value = Average Purchase Value x Average Purchase Frequency Rate

5.90 × 4.2 = 24.78. So, the customer value is $24.78 per week.

4. Calculate the Average Customer Lifespan.

While Kissmetrics does not explicitly state how it measured Starbucks’ average customer lifespan, it lists this value as 20 years.

5. Finally, we can calculate Customer Lifetime Value (LTV)

Finally, we can use the average customer value and average customer lifespan to get the CLTV. Since our customer value is based on weekly spending, we first convert it to an annual figure by multiplying it by 52 weeks. Then, multiply the result by the average customer lifespan.

LTV = Customer Value x Average Customer Lifespan

24.78 × 52 × 20 = 25,771.20. So, the CLTV for a Starbucks customer is $25,771.20.

The Importance of Balancing LTV and CAC

To be viable, a company model has to have a lifetime value (LTV) that is far higher than its customer acquisition costs (CAC). Profitability will suffer immensely if it takes more to bring in new clients than what they spend on your merchandise. On the other hand, a profitable client base is indicated by a low CAC and a high LTV.

This balance is also crucial for long-term sustainability. When LTV justifies CAC, resources are used efficiently, helping you adapt to market changes and remain competitive.

Neglecting this balance can be disastrous. Take Casper, for example. In 2019, the mattress brand spent $104.7 million on advertising. Even with this enormous investment, they faced severe trouble. Why? Their retention rate was low, with only 20% of sales from repeat customers. As a result, they lost $157 for every mattress sold.

What is the Customer Acquisition Cost vs Lifetime Value Ratio?

The balance between these two metrics is the LTV to CAC ratio. It helps you evaluate the profitability of your customer acquisition efforts and decide whether to upsize or downsize your marketing and sales strategies.

- How do we calculate the LTV vs. CAC ratio?

To obtain the LTV to CAC ratio, follow these simple steps:

- Calculate the customer acquisition cost (CAC).

- Determine the customer lifetime value (LTV).

- Finally, divide LTV by CAC.

For instance, if your LTV is $300 and you have a CAC of $50, the ratio would be 6:1. You generate $6 for every dollar you spend on getting new customers.

What is a Good LTV to CAC Ratio?

How do we interpret this number? If your ratio is one or lower, it’s a red flag. It shows you’re not making enough revenue to cover your costs. A low ratio could point to financial issues and might mean you need to cut costs or improve customer retention.

The industry benchmark is 3:1. This indicates that you’re making three times the amount spent on acquiring each customer. A ratio of 3-4:1 is typically regarded as the optimal ratio that balances cost and growth. What about our calculated 6:1 ratio? A high ratio suggests you are underspending on customer acquisition and may be missing opportunities for further growth.

Common Pitfalls in Balancing LTV and CAC

The LTV/CAC ratio is not without its problems. Let’s break down some critical issues that can lead to misinformed decisions.

-

Inaccurate CAC

If you think CAC only requires adding up your marketing expenses, that is incorrect. It’s actually more complex than that. You’ve got to pull data from CRM systems, financial records, and payroll reports. Keeping all these numbers precise and up-to-date requires meticulous attention to detail. Any inaccuracies in this number can greatly skew your ratio, causing you to steer your strategies in the wrong direction.

-

Changes in Churn and Retention Rates

Customer behavior can be highly unpredictable, fluctuating wildly due to market shifts, new competitors, or broader economic changes. That’s why relying only on past data to predict future trends can lead to trouble. What happens if you face new competition and suddenly, your customers start leaving? An unexpected spike in churn rates can quickly tank a previously healthy ratio.

-

Misinterpreting LTV as Present Revenue

Lifetime Value (LTV) does not represent your current revenue. Instead, it’s based on future earnings rather than the income you are currently generating. If you are a new business, estimating LTV is particularly tricky due to limited data, leading to overestimation. A startup projecting a high LTV without enough customer history could cause a skewed ratio, making the business appear more profitable than it actually is.

-

Restrictions Within Company Scope

The LTV/CAC ratio measures sales and marketing efficiency, but it’s only part of the picture. Operational efficiency, product development, and customer service are also crucial for financial health. Ignoring these areas can give you tunnel vision. For example, a high LTV/CAC ratio might hide other issues, like slow product development.

How to Improve LTV to CAC Ratio

Tracking your Customer Acquisition Cost vs. Lifetime Value ratio is crucial for gauging shifts in your customer acquisition efficiency over time. Consider taking the following steps if you notice a downward trend or see potential for more growth:

-

Personalize Customer Experience from Day One

Start by truly understanding your customers’ unique needs and behaviors. For example, if a customer buys running shoes, suggest complementary athletic wear. You can offer value beyond transactions, like recipes, how-to videos, or community stories. Personalization can encourage repeat visits and strengthen their connection to your brand.

-

Provide In-App Guidance to Boost Customer Engagement

Help customers benefit from your offerings with detailed walkthroughs. Guiding your customers can make the onboarding process smoother and more enjoyable. Personalized guidance can mean detailed app guides or attentive staff.

-

Implement Contextual Modals to Grow Accounts

Use modals—overlay windows based on app usage—to drive account expansion. They can promote upsells, cross-sells, or add-ons precisely when customers see their value. If you’re in retail, discount related products or exclusive bundles to frequent buyers.

-

Enhance Customer Retention with Secondary Onboarding

Offering ongoing support and guidance to current customers can reduce churn or customer attrition. Support can take the form of personalized recommendations, loyalty programs, exclusive events, and excellent customer service. This proactive approach creates a positive customer experience, encouraging repeat purchases and brand loyalty.

-

Monitor and Analyze Customer Behavior to Eliminate Friction

Monitor customer behaviors and address friction points using surveys or direct observation. Identify areas where they might lose interest and improve them to boost conversion rates and retention.

-

Use Customer Feedback to Improve Satisfaction

Actively solicit feedback to show customers that their opinions are valued. Taking action on feedback demonstrates that you care and are committed to improving. Following their feedback increases satisfaction, making them more likely to stay with you and recommend your service to others.

Additional Metrics to Track

Aside from LTV and CAC, there are other metrics you can track to assess your business performance. These include:

-

Average Revenue Per User (ARPU)

Average Revenue Per User (ARPU) measures the income from each user over a set period. It helps evaluate how well your marketing, pricing, products, and customer service are performing. When you track ARPU, you can identify areas for improvement and make changes to boost overall sales.

-

Cohort Analysis

Cohort analysis involves grouping users based on shared characteristics. These cohorts can be based on acquisition time, purchasing behavior, or simply their preferences. Analyzing these characteristics can help uncover patterns and measure retention. You can also use cohort analysis to determine how well a particular strategy works in different groups.

The Role of Customer Segmentation in Balancing LTV and CAC

Customer segmentation categorizes customers by demographics, behavior, and interests. By segmenting, you can target specific groups that generate the most revenue. Take high-end fitness brands, for instance. They can tailor promotions to health-conscious individuals, boosting sales and reducing marketing costs. This strategic approach balances the effort between acquiring and retaining new customers.

Leveraging Technology for Better LTV and CAC Management

AI and data analytics analyze extensive data sets, identify trends, and offer real-time insights into campaign performance and customer interactions. These tools allow rapid strategy adjustments to maximize return on investment (ROI). Thanks to AI personalizing marketing messages and offers, conversion rates increase. Additionally, AI-powered A/B testing simplifies finding the most effective tactics.

Final Thoughts

Finding the right balance between key business factors is essential for steady growth. Customer acquisition cost (CAC) helps measure the effectiveness of your marketing efforts while knowing each customer’s Lifetime Value (LTV) shows their long-term worth. A high LTV to CAC ratio is a good sign that you’re on the right track.

You can enhance this ratio by delivering customer experiences that entice customers to stay and keep coming back. Strategies include personalizing interactions, offering top-notch support, and maintaining customer engagement. If you haven’t already, calculate your LTV and CAC to see where you stand. Afterward, apply these techniques to keep your finances healthy.