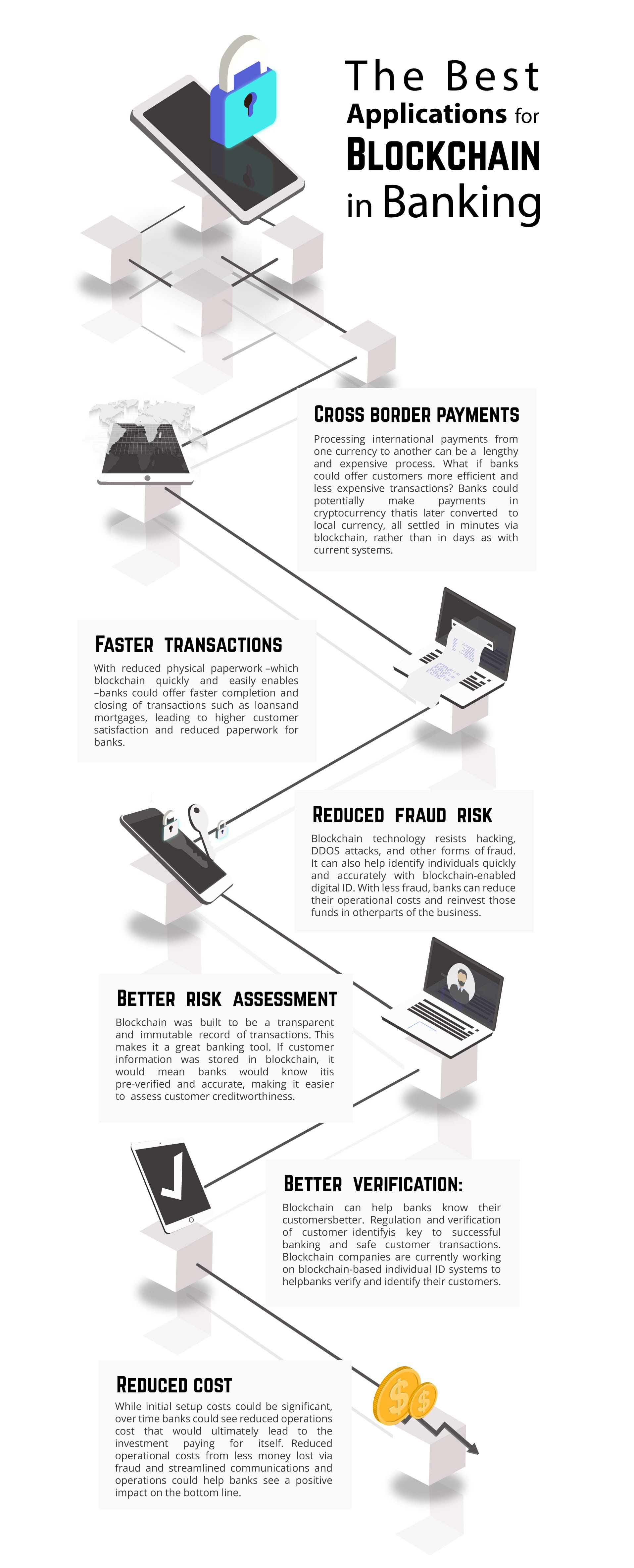

Blockchain is on the rise as a tool that can increase security and help businesses work more efficiently. Banks are finding more applications of blockchain technology in banking for their operations. In fact, many say that the future of banking may be dependent on blockchain.

There is more data in the world now than ever. Businesses depend on it to not only serve their customers and manage important records but also to analyze demographic and behavioral information that will help them create continued communication that has an impact in terms of growing new business and retaining existing customers. But managing this data safe is paramount. As customer security and privacy become a bigger issue for both B2B and B2C organizations, businesses are being forced to consider their options in terms of how they handle customer data.

Blockchain is one way that businesses are working on handling their data management. As a distributed decentralized ledger, it offers a secure record of transactions and helps businesses both process information more efficiently but also store and access it safely and reliably.

Blockchain has several advantages in terms of how it can help banks manage information, confirm records, guard customer privacy, and even streamline operations and cost. Here are some ways that banks are using to leverage this technology to their benefit.